quickbooks credit card processing time

Intuit doesnt appear to use independent sales agents but does have a reseller program that allows other sales organizations to market and sell its services. If you process customer payments before 3 PM PT well deposit them in your bank account the next business day.

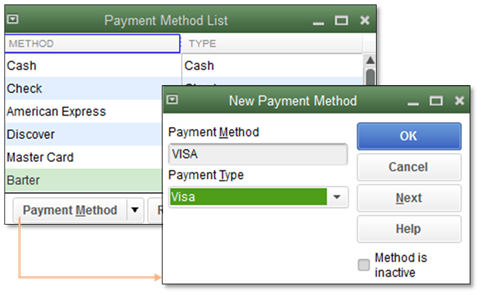

How Can I Input A Customer S Credit Card Informati

Time To Pet shows you a complete breakdown of all payouts in the Time To Pet Payments.

. Add the details of the credit card or you can also swipe the credit card using the Swipe card option. QuickBooks will provide step-by-step instructions. Their flat fee however starts at 025 for smaller transactions but can go up as high as 2 or more if youre making larger payments in bulk.

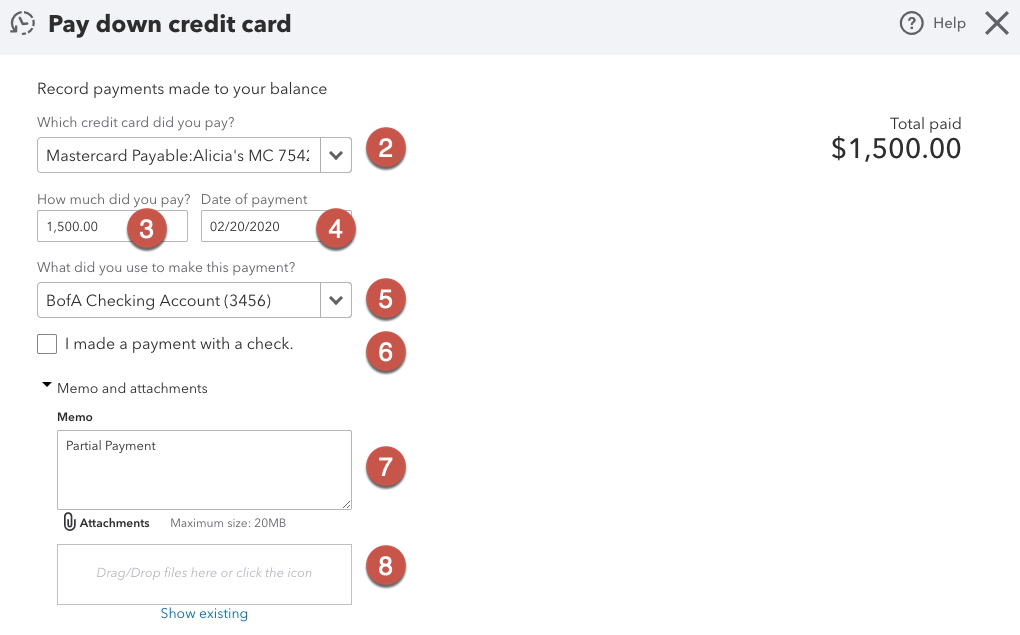

You can select that option right away and click OK or you can go in and write a check at a later time. Be aware though that many customers have reported long hold times and insufficient responses. Then tick mark the checkbox named Process credit card refund.

Accept payments from multiple services. Store multiple payment methods. A certified QuickBooks advisor Fi-Soft is a company that offers real-time credit card processing integration for QuickBooks.

Fi-Soft is not a gateway which means youll need a compatible gateway in addition to a merchant account in order to accept credit cards and transfer the data to QuickBooks. When compared with other payment processors QuickBooksmerchant services are far from being the most cost-effective option. It can take one to three business days for an online or phone payment to post to your credit card account and reflect in your available credit.

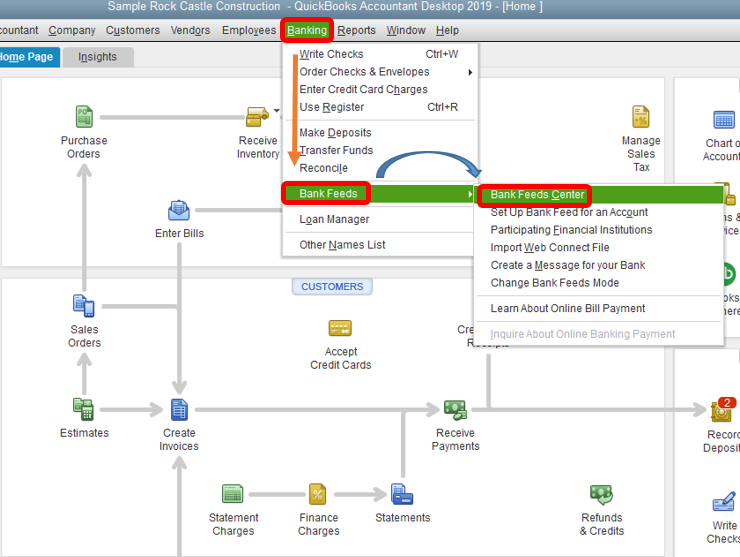

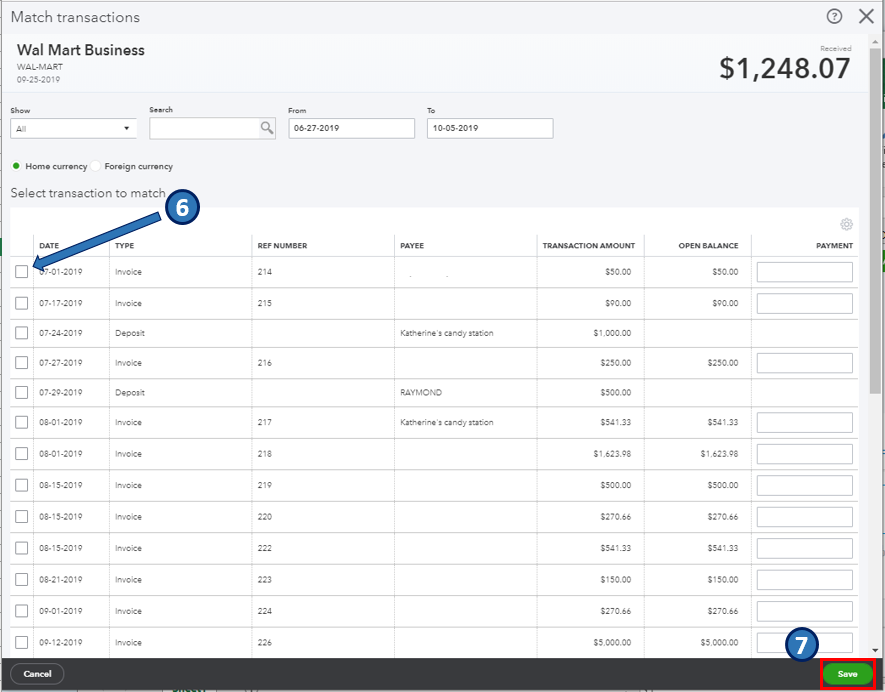

Click transactions or banking on the left side panel. Verify Type Of Credit Card Transaction. QuickBooks ach payments take 5 days to settle which is too long a time for the bank to bank transfer.

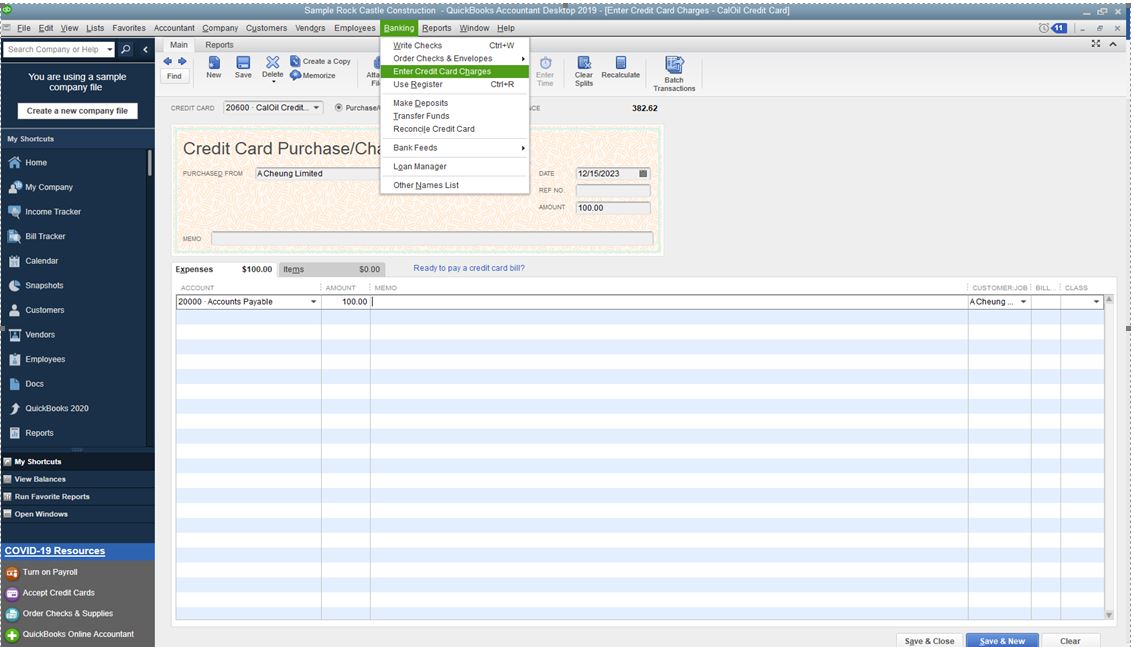

Select the proper credit card for the credit card charge you want to enter if you only have one credit card QuickBooks will automatically select that credit card account. Recording Credit Card Fees for Time To Pet Payments Reviewing Fees. After you click OK you may receive this popup notification about your.

At QuickBooks we charge 29 for invoiced cards plus 025 per transaction. Credit card processing financial accounting times can vary but merchants usually have the money within one to three days. The company that processes your credit card fee including QuickBooks as well as Square Stripe WePay and others take a fee to collect for the credit card companiesThese fees are charged every time you do a transaction.

Deposits are referred to as Payouts in Time To Pet Payments. Eliminate CSV files and manual batch processes. We deposit most credit card and ACH payments next day.

Syncing bank and credit card accounts to QuickBooks will save time and will eliminate most coding errors. Upload Receipts From Your Phone. Take a moment to make sure that PurchaseCharge is selected so that your credit card charge is properly recorded.

The Write a check for payment now option makes entering a credit card payment easy. Yes that is right. When you are done with all the above steps then click on the OK button.

QuickBooks credit card processing option is primarily marketed through direct email and mail marketing online advertising and via the QuickBooks accounting software. The latest version of Quickbooks will not process credit card payments on computers using the latest version of internet explorer. Many businesses have to key in card payments from time to time so that rate is bound to go up.

The cost of QuickBooks processing varies depending on how much you need to process per month and your plan. Types of credit card transactions for processing depositing cash in the merchant account next-day for payments by 3 pm Pacific Time or 2-day after 3 pm and automatically recording in QuickBooks Online include. Quickbooks merchant services support.

Quickbooks Payments prioritizes customer rates depending on a few different factors. Connect your bank and credit card accounts to QuickBooks. With this QuickBooks Online feature you no longer have to worry about the time-consuming process of working with scanners.

The minimum per-transaction rate is 24 and that only applies to swiped cards. With QuickBooks Online you can check on your customers invoices and more from any smartphone device. Quick books seem to not support the new same-day ACH payment featureWith the new same-day ach payment feature you can receive payments using the bank to bank transactions in your account in a day.

First you need to account for the processing fees included in the deposit into your bank account. Payments sync into your accounting software. If you process payments after 3 PM PT well deposit them in two business days.

Intuit offers a knowledge base along with email support. If you have already added the bank or credit card account in QuickBooks select the account when prompted. QuickBooks Credit Card Processing with GoEmerchant allows you to process credit card payments and ACH payments within QuickBooks quickly and easily.

However there are more fees per transaction that business owners need to be aware of before selecting Intuit QuickBooks credit card processing option. 1 Thats because payments made using a checking account and routing number are processed in batches overnight and not in real time. For next-day deposits in QuickBooks Online.

Several processors and gateways offer Fi-Soft including USAePay. QuickBooks users will save time by authorizing credit card payments from within QuickBooks and eliminating the need to enter credit card transaction data into a POS device or Virtual Terminal and again later to. Recording Credit Card Fees for WePay.

Keyed payment fees 3425. If you plan on using QuickBooks only to accept payments the 1250 per month minimum price tag and QuickBooks high credit card processing fees make the service a lot less viable. QuickBooks will take you to this screen.

Now that youve gotten an overview of what you should know when accepting payments for your products and services its. Research estimates that 55 of small businesses dont accept credit card payments from customers. Phone support is available Monday to Friday from 500 am to 700 pm Pacific time and Saturday from 600 am to 400 pm.

Then click on the type of credit card you want to refund for. If the QuickBooks transaction fees were the only fees that businesses incurred it would be the perfect card processing solution. While electronic payments are faster theyre not instant.

Then click on the type of credit card you want to refund for. This is great for business owners on the go or with multiple business locations.

How Can I Input A Customer S Credit Card Informati

How To Accept A Credit Or Debit Card Payment In Quickbooks Online

Solved Best Way To Connect Credit Card Charges To Bills

How To Enter Credit Card Charges In Quickbooks Youtube

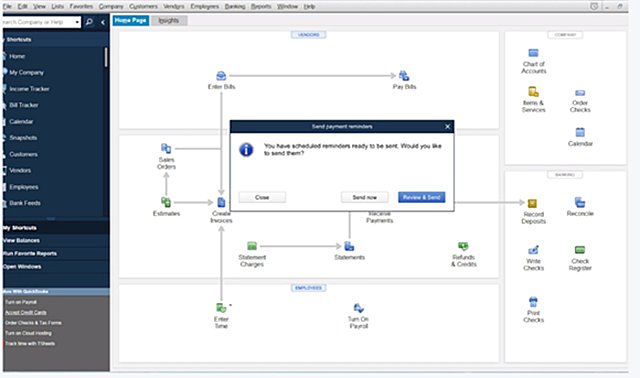

Quickbooks Desktop 2020 Automated Payment Reminders Insightfulaccountant Com

How To Enter Credit Card Charges In Quickbooks Webucator

Quickbooks Online How To Record And Process Credit Card Payments

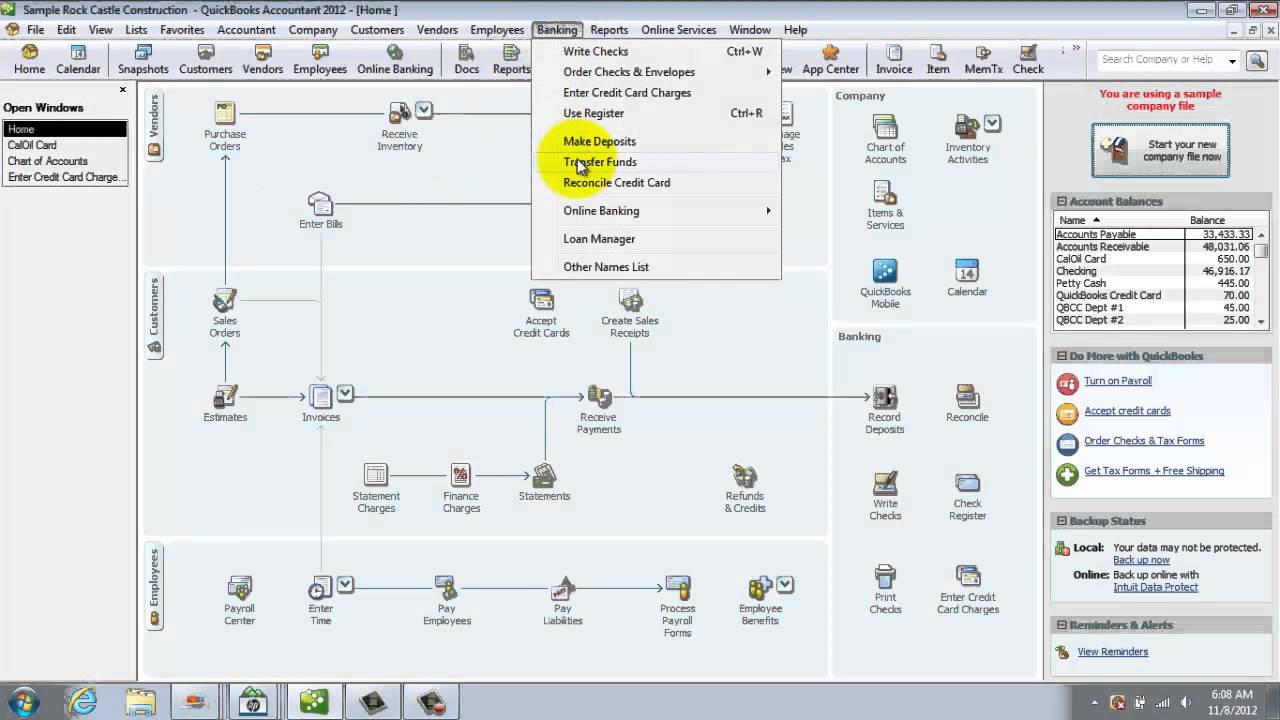

Entering Credit Card Transactions In Quickbooks Pro 2013 Simon Sez It

How To Enter Credit Card Charges In Quickbooks Webucator

Entering Credit Card Transactions In Quickbooks Pro 2013 Simon Sez It

How To Handle Merchant Fees In Quickbooks

Quickbooks Payments 2019 Review Zipbooks

Solved Importing Credit Card Transactions

How To Record Credit Card Payments In Quickbooks

Recording Credit Card Fees In Quickbooks Time To Pet Knowledge Base

How To Handle Merchant Fees In Quickbooks

Pay Down Credit Card In Quickbooks Online Quickbooks Credit Cards

How Do I Make A Credit Card Receipt And Email To The Customer

Solved How Do I Record A Credit Card Credit Given To Me By The Bank To Refund A Fraudulent Purchase